Shifting US Consumer Behavior in the Face of COVID-19

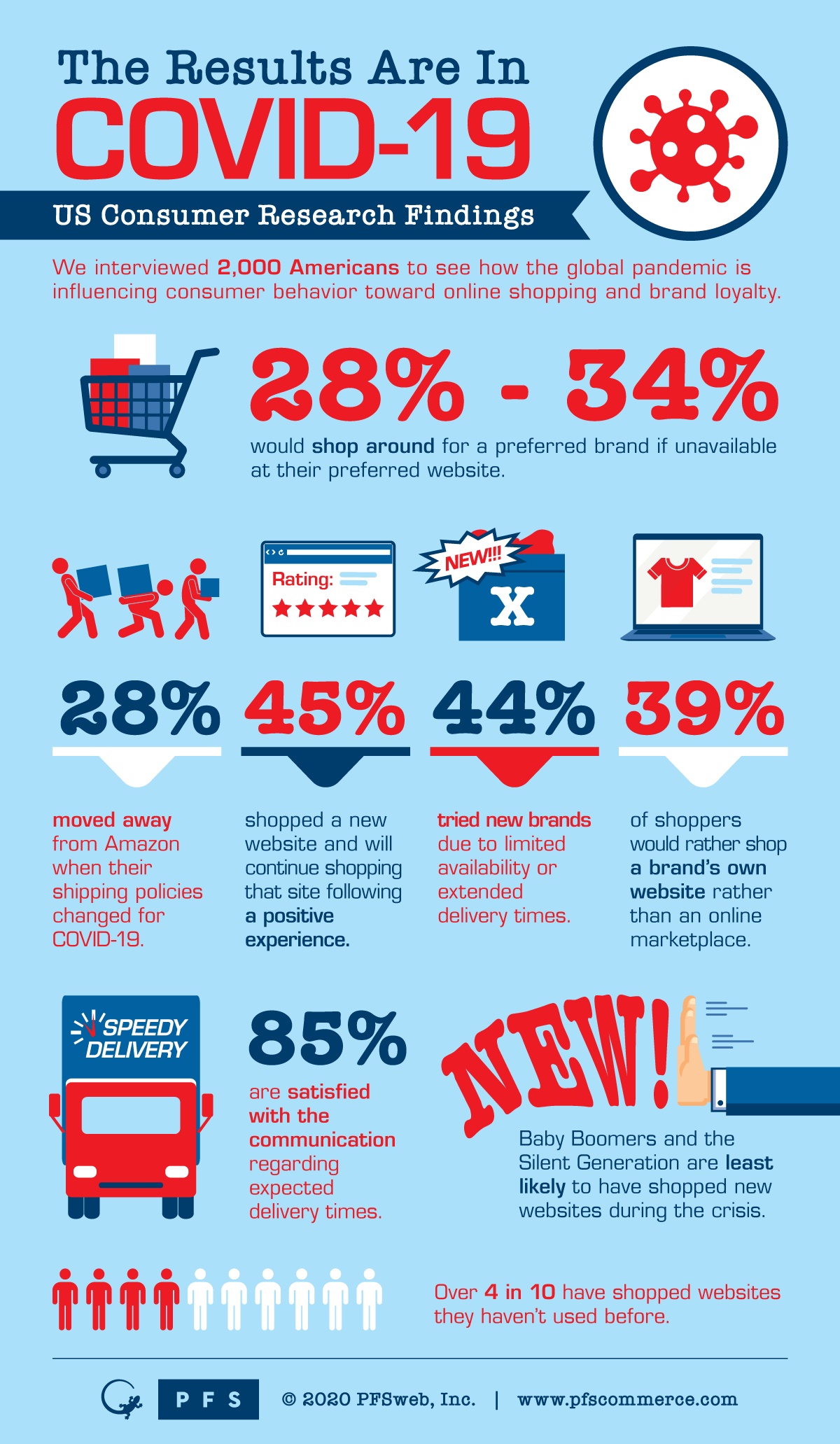

COVID-19 has forced many US consumers to alter their shopping preferences. Consumers are now finding themselves shopping with what is available versus what is preferred. While many shoppers are still loyal to the brands they love, COVID-19 is driving an even greater change in mindsets. This shift impacts the type of goods and brands consumers are able to purchase and the shopping channels they use. PFS recently surveyed 2,000 US consumers to gauge how COVID-19 has changed these new shopping behaviors.

These changes are likely here to stay long after the pandemic is over. Consumers are living, shopping and likely thinking differently than ever before. Social distancing came as a shock to many people, and early consumer behaviors were sporadic. Yet, now that we have had time to digest our current landscape, new actions have become standard, as 90 percent of consumers across the globe expect COVID-19 to impact their routines for more than two months after the lockdown.(1) For brands and merchants, this means being aware of this shift to best position themselves for success in our new reality.

Brand Loyalty Tied to Availability

What we’ve seen tested early on in the pandemic has been brand loyalty. Companies spend millions on building a brand and curating a seamless customer experience. Per our recent US consumer research report, 44 percent of US shoppers have tried at least one new brand during the COVID-19 pandemic because their standard brand was either unavailable or took too long to be delivered. As well, this figure rises to 56 percent for Millennials and is the lowest among Baby Boomers.

Few companies could have prepared for the fallout due to COVID-19 and the lingering impacts on supply chains and delivery. Many consumers have been forced to look outside their preferred brands due to what is available in their geography. For luxury items, some shoppers may be able to withstand longer fulfillment times; however, for essential goods, household items or consumables, shoppers will likely be forced to go with what is available. Thus, consumers are now experiencing interactions with new brands for the first time. These are make or break moments, as shoppers are admittedly purchasing these brands because of their availability. A poor eCommerce experience could turn-off a shopper for good, while a seamless experience could lead to a new brand advocate. PFS research shows that 45 percent of US consumers have shopped with online retailers they have not previously purchased from during the COVID-19 pandemic and intend to continue shopping with them based on the excellent experience they had.(2)

Adapting Channel Strategies

Apart from changes to brand loyalty, COVID-19 has also summoned challenges across shopping channels. With social distancing in place, eCommerce has essentially become the single platform for consumers to buy goods. This has put further strain on the supply chain, as many brands were not prepared for Black Friday levels of eCommerce volume at the end of Spring, which led to many eCommerce sites unable to fulfill orders on specific goods.(3) While some shoppers have jumped to other brands, this is not always the case. According to our recent report, around 30 percent of consumers would shop around if their preferred brand was not available from their preferred website, rather than buy from a different brand.

As well, Amazon’s decision to delay shipment of non-essential goods has led to significant behavior changes for both consumers and merchants. From our report, 28 percent of consumers have moved away from Amazon as their preferred website for online shopping since Amazon has changed their shipping policies, raising to 39 percent for Millennials. Consumers have been forced to navigate new channels to find goods, and merchants have to pivot to try new sales and delivery channels. This makes it clear that non-traditional fulfillment methods like pop-up distribution centers can provide a flexible and cost-effective solution to this issue for brands.

Consumers have also shown an affinity to cut out the middleman and buy directly from brands themselves. 39 percent would rather shop directly on a brand’s website rather than a marketplace website.(2) Thus, DTC brands must be ready to cultivate a seamless experience for shoppers straight from their site, from check out to last-mile delivery.

Many retailers have had to rethink their approach since the onset of COVID-19 due to a myriad of factors. Yet, in order to achieve sustainable success, brands must take stock of changing consumer behaviors and adapt their plans accordingly. While retailers cannot predict the future, they must stay informed to mitigate drifting fallouts from the pandemic. Our infographic below is a great resource for merchants to stay ahead of these changing consumer behaviors to best position their brand for future success.

- https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/a-global-view-of-how-consumer-behavior-is-changing-amid-covid-19

- Based on all respondents excluding those who selected not applicable to me.

- https://www.accenture.com/us-en/insights/consumer-goods-services/coronavirus-consumer-goods-rapid-response